When William Barr, Donald Trump’s nominee to be the next attorney general, chaired the compensation committee on Time Warner’s corporate board, he delivered every raise and bonus bump the executives running the company desired, all while they laid off thousands of workers.

Barr served on the committee from 2009 to 2017, and chaired it from 2012 to 2017. During that time, according to SEC filings provided by Democratic PAC American Bridge and reviewed by Splinter, Barr and the rest of the compensation committee consistently served as a rubber stamp for executives at Time Warner, providing them with annual raises and bonuses that stretched far into the millions. Simultaneously, the company was cutting staff at places like CNN, despite the media outlet posting annual profit increases. Barr did not respond to Splinter’s request for comment.

Barr was nominated to serve as attorney general by President Donald Trump in December 2018. His confirmation hearing was recently delayed 10 days over concerns voiced by Democrats tied to Barr’s opinions on presidential indictment.

He boasts a resumé that would make any money-hungry lawyer jealous and has already served one stint as attorney general after being appointed to the post by President George H.W. Bush following the resignation of Richard Thornburgh in 1991. There, Barr spent his time talking up the ongoing assault on abortions by state legislatures and encouraging the sprawl of the U.S. prison system. After Bill Clinton’s 1992 victory over Bush, Barr ducked out to the private sector, where he has remained ever since.

Barr spent the past 25 years in a host of corporate gigs. He served as general counsel and executive vice president for GTE Corporation, a massive telecommunications company that was bought out by Bell Atlantic in 2000. The merger of Bell Atlantic and another company created Verizon, where Barr stayed on in the same roles from 2000 to 2008. All the while, he maintained a job as counsel at the law firm of Kirkland & Ellis, where he left in 2009, returning in 2017. Barr’s experience in telecommunications mergers and corporate legalese set him up well, and in 2009, Time Warner tapped him to join its board of directors. He served on the compensation committee the entire time, stepping up as the committee chair in 2012.

In that role, he made a fortune—$1.97 million in cash payments and even more in stock options—simply by chairing a committee that never seemed to say no.

Nothing illegal happened during his time there; Barr never broke any company rules or did anything outside the law. So in one sense, there is no scandal here.

In another sense, of course, the lack of a scandal is the biggest scandal of all.

In 2008, the year before Barr came aboard, Time Warner named Jeff Bewkes as its new CEO.

With Time Warner attempting to weather the oncoming financial crisis as best it could, it was believed that having someone come in to Shake Things Up would be the best move for the company, and Bewkes, the former CEO of HBO, appeared to be just that person. In October 2008, he oversaw Time Inc.—Time Warner’s print division—as it cut six percent of its staff. In 2009, he made the decision to dissolve the Time Warner-owned movie production company New Line, combining it with the company’s Warner Brothers. The move cost 600 workers their jobs. It was a harbinger of the times to come. (Neither Bewkes or Time Warner responded to Splinter’s request for comment.)

According to SEC filings from 2011, the compensation committee boosted Bewkes’ salary from $1.75 million to $2 million in 2010, a year into Barr’s tenure on the committee. The committee also signed off on boosting the amount of his target bonuses—money that he would collect if the company hit certain business-related goals, such as company revenue growth or stock price increase. The committee decided to raise Bewkes’ target bonus from an initial $8.5 million to $10 million. And Bewkes was not alone: In addition to a $500,000 pay bump to his $1 million base salary, Chief Financial Officer John Martin had his target bonus increased by $1.75 million. Likewise, General Counsel Paul Cappuccio happily accepted a $250,000 raise, bringing his base salary to $1.25 million.

Since all the executives hit the targets laid out in their contracts in 2010, the compensation committee decided to give them an even bigger bump, with the final figures topping out at 146 percent of their already-increased amount. In its filing, Time Warner wrote that the committee was bumping their bonuses for delivering “very strong financial and operating performance despite the difficult and uncertain economy.”

To put that plainly, Time Warner shelled out $27.67 million in bonuses alone for five individuals that year.

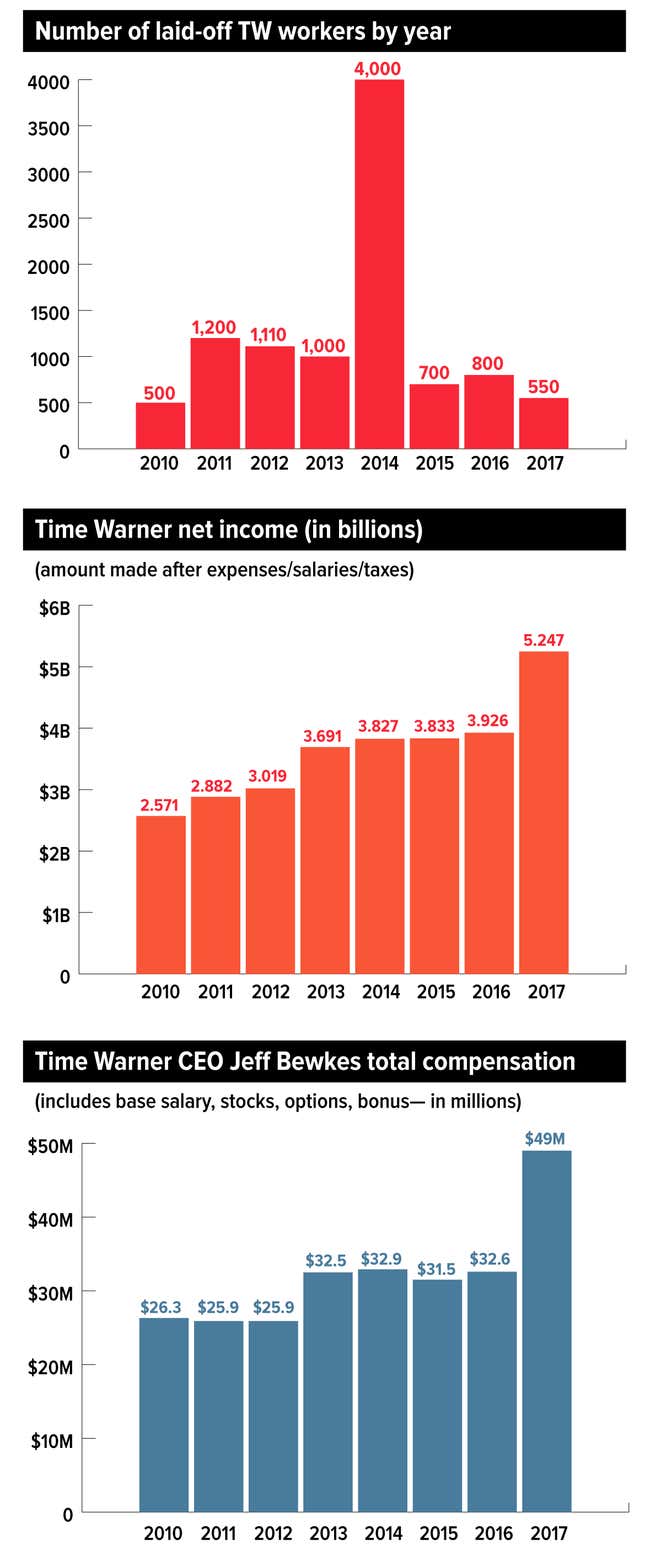

At the same time, Time Warner’s executives, chiefly Bewkes, were talking publicly about cutting costs, which in turn meant cutting the jobs hundreds depended on for their livelihoods. In 2010, the same year its executives saw tens of millions in bonuses, the company laid off 500 workers, per the same SEC filing. That number would only grow, along with the bloated salaries of the men and women running the show.

In a 2011 interview with the New York Times from his office in the Time Warner Center, Bewkes lamented the $500 million in overhead the company was paying in New York City real estate related costs. The Times reported that the company was consolidating its office space as “part of a larger effort to slim down a company.” (The piece was headlined “Time Warner Trims Its Excesses.”) Time Warner let go 1,200 workers by the year’s end. Fifty of those laid off came from CNN, with the company citing “workflow changes.” The same year, Bewkes was the owner of 290,244 shares in the company as part of his structured payment, per Time Warner’s April 2012 SEC filing. While his salary remained at the same rate as the year prior, the bonuses for Bewkes and four other executives, including Martin and Cappuccio, were all given 136 percent ratings.

2012 brought a major pay bump for Bewkes and a promotion for Barr, who was named the chair of the compensation committee, taking over the role previously occupied by Stephen Bollenbach, a former CFO and CEO for a number of hotel businesses (including a two-year stint with The Trump Organization in which he pulled the company out of bankruptcy.) The compensation committee approved a raise in the CEO’s potential bonus by $6 million and in November, Bewkes signed a contract extension to keep him at Time Warner through 2017. From that Nov. 20, 2012 SEC filing:

The Compensation Committee will continue to determine the amount of the annual bonus paid to Mr. Bewkes based on the Company’s and his performance. The target value of annual long-term incentive compensation will increase from $10.0 million to $16.0 million beginning in 2013. The Compensation Committee has approved a long-term incentive structure consisting of a mix of stock options and performance stock units, the value of which are tied directly and solely to the Company’s future financial performance and shareholder returns, and that does not include time-vested restricted stock units.

Time Warner laid off 1,100 people that year, and none of the executives mentioned the dropped employees in their fourth quarter earnings call. Once again, executives were gifted with bonuses exceeding their initially set rates, with the top-five all raking in 36 percent more than what was supposed to be the maximum amount of available bonus cash, according to SEC filings. For Bewkes, this meant a $13.6 million payday.

2014 saw the highest number of layoffs dished out by Time Warner in the time that Barr chaired the compensation committee. It also heralded a revenue bump of nearly $1 billion dollars for the entire company, a three percent increase over the previous year’s haul, per a February 2015 SEC filing. With the increase in revenue came another round of base salary, stock options, and bonus raises for the company’s executives.

But as Barr and the committee rubber-stamped the raises for Time Warner’s C-level executives, the company continued to hemorrhage workers, chiefly in its media division, operated by Turner Broadcasting System. That year alone, Turner was tasked with firing 10 percent of its overall staff, or 1,475 workers. Of those, 975 workers located at Turner’s headquarters in Atlanta were forced into unemployment, according to the New York Times.

CNN, helmed by Jeff Zucker, was forced to cut ties with 300 workers: Per the Hollywood Reporter, just 130 took voluntary buyouts that were offered, forcing CNN to fire 170 other staffers. Crossfire, CNN Money, Unguarded, and Sanjay Gupta MD were all canceled. Elsewhere, reporters such as Capitol Hill correspondent Lisa Desjardins were cut loose via multiple rounds of disheartening mass emails.

According to New York magazine, the cuts caused many CNN employees to raise an eyebrow, given the company’s recent financial success.

CNN staffers described the memo to me as “harsh,” “soulless,” and “a disaster.” “It was just greeted with disdain,” one producer said. The frustration stems from the fact that CNN is having a record year of profits. It will make $600 million this year, and, according to sources, the network is on track to generate a $1 billion profit by 2017 on the strength of its long-term cable subscriber deals.

By the time 2014 came to a close, Time Warner had laid off 4,000 workers. This was all deemed necessary by the executives; Variety wrote that Bewkes was “under pressure to boost earnings” after turning down Rupert Murdoch’s offer to buy Time Warner earlier that year. Meanwhile, Barr and the compensation committee, acting as though everything was business as usual, continued to stuff the C-level’s pockets with extra funds.

The final three years of Barr’s reign atop the compensation committee were more of the same, rinsing and repeating the same pattern. Time Warner laid off a combined 2,500 workers between 2015–2017. Various reasons were given: corporate restructuring, relocation efforts, poor box office performances, overlap brought on by mergers. What remained the same was the fact that both the executives’ rates and the company’s revenue increased every single year. In 2017, Time Warner attempted to negotiate a contract with labor unions that would have gutted the workers’ pension and healthcare plans. At the same time, Bewkes’s take-home pay skyrocketed. When Barr stepped away from Time Warner in 2017, the company’s CEO was taking $49 million to the bank, the majority of it coming from stock options.

As of their 2017 filing, Time Warner employed approximately 26,000 employees. By the time Barr’s run was done, Time Warner had fired 10,000 workers over the course of eight years and raised the salaries and bonuses of the top-five executives by a combined $1.6 million in base salary pay, nearly $200 million in bonuses, and tens of millions more in stock options.

If your eyes glazed over a bit while reading all that, you’re not alone.

As proved by Joe Ricketts, to be boring is the best way to become wealthy. The reason these dots are connected only in mind-numbing SEC filings and not the New York Times or Wall Street Journal is precisely the aim of the executives hauling in a lifetime’s worth of money in a single calendar year. Both the Times and the Journal have reported on Bewkes’ growing pay, but almost always in relation to stock growth rates and shareholder returns and mergers, not the mass layoffs or stagnant wages, which were deemed savvy, necessary business decisions.

So, to help further break down just what exactly Time Warner and Barr were participating in, I spoke with one person who’s managed better than nearly anyone else to understand the sly maneuvers that enrich the few at the top: William Black.

Black’s resumé on the matter of executive compensation and corporate greed extends for decades. He was one of the loudest and most sane voices in D.C. during the Savings and Loans crisis of the 1980s and 1990s (if you remember the Keating Five from history class, thank Black!) and has spent the years since providing a no-bullshit look at the hidden incentives that plague the financial and corporate sectors of American industry. This included being called before Congress to offer a scorching prepared testimony on the Lehman Brothers in 2010.

According to Black, the basics are as follows: All the real money being paid to these executives is tied up in what are, on their face, bonuses triggered by performance-based incentives. The idea is to make as much money as possible, as quietly as possible; should anyone ask why, exactly, one person deserves to make $49 million in a single year, as Bewkes did in 2017, you then point to stock performance as a signal that the amount is correct and, most importantly, earned. The problem emerges when executives realize this and structure their companies to ensure they “hit their number.” When they don’t, methods like former GE CEO Jack Welch’s infamous rank-and-yank—annual cullings in which under-performers are unceremoniously fired—are instituted.

“Compensation is the central problem and not because of wealth effects, but because of the perverse incentives it creates,” Black told Splinter in a phone interview. “It creates incentives to engage in what we call control fraud and predation. Control fraud is when people who control a seemingly legitimate entity use it as a weapon to defraud or predate on others. And there are enormous advantages to being seemingly legitimate, as you can see from the Trump world. This is really a criminal enterprise but that seeming legitimacy is all the difference.... It allows it to occur with total impunity.”

Black said that in such environments—where “hitting the number” becomes the sole focus of the executives, so as to trigger these insane bonuses—the subsequent hiring standards of major companies drop and drop and drop, creating a “criminogenic environment” in which identifying an issue is nearly impossible because “the problems become epidemic.” Think the recent Wells Fargo scandals, for instance. By distancing themselves from the actual shady shit, company executive types have plausible deniability and thus are never held accountable for anything other than whether or not the company’s stock rises high enough to set off their bonuses.

Now, the question of the hour: Do William Barr’s actions as chair of the compensation committee undermine his claim to the position of attorney general? Unfortunately, unless you’re an anti-corporatist or ardent Never Trump or both, the answer, legally speaking, is no. Basically, what William Barr and the rest of his cronies on the Time Warner board were doing was not revolutionary or legally foul or unique. It was the exact same set of practices that had long been adopted by the majority of Fortune 500 companies by the time he came around, especially those like Time Warner with deep roots in the finance industry. For instance, AT&T, which merged with Time Warner amidst a Justice Department appeal last year, has consistently posted record profits over the last seven years and still laid off 16,000 workers between 2011 and 2018.

By normalizing these compensation and employment practices, the folks in the boardroom effectively control the compensation committee, meaning Barr was little more than a well-paid attorney that Time Warner kept as a shiny trophy and not much else.

“It begins with the hiring of the compensation firm. That’s where the secret sauce tends to be,” Black told Splinter. “Those folks work as a one-way ratchet, and that direction is up. The CEO and the CFO are going to hire these folks, or be influential in who gets hired, and everyone knows the deal. They’re going to come in and ask the board, ‘So, we’re here to serve you. Tell us what you want to do.’”

He continued: “The compensation committees tend to rubber-stamp all these things. They tend to be dominated by the board. They’re a showpiece. Look at Enron, it had a board of directors that looked like God’s version of the Magnificent Seven, except I think they were 11, and they just utterly rubber-stamped the frauds. Dominant CEO-types run these things.”

Now, does any of that make what Barr and Bewkes and Time Warner did any less heinous or their actions any less morally objectionable? Of course not. They are simultaneously products of their environments and mooching asshole one-percenters that should be taxed to death and then taxed some more. And the idea that someone that happily participated in that sham of a routine could serve (again) as attorney general should be terrifying if wasn’t already so normal.

The hardest part is staying awake long enough to realize how fucked up it all is, and that’s exactly the point.